Reports

& Guides

We value transparency where all stakeholders can make intelligent & informed decisions.

Reports

The following reports provide ongoing & independent real estate market analysis on pricing and affordability.

UBS Global Index

Updated Yearly - Last Update: 2022 10

UBS Global Real Estate Bubble Index

“Price bubbles are a recurring phenomenon in property markets.

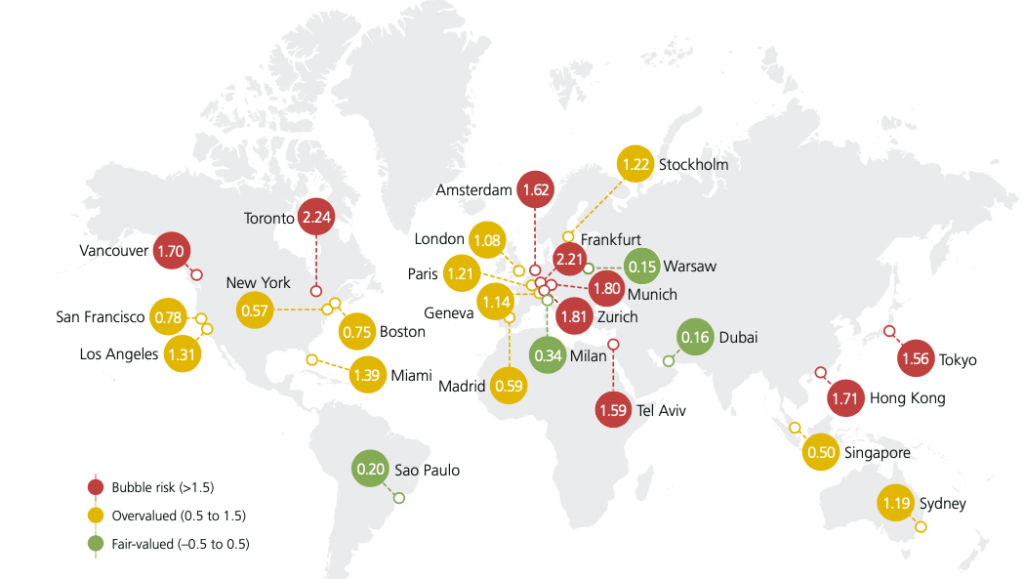

The term “bubble” refers to a substantial and sustained mispricing of an asset, the existence of which cannot be proved unless it bursts. But historical data reveals patterns of property market excesses. Typical signs include a decoupling of prices from local incomes and rents, and imbalances in the real economy, such as excessive lending and construction activity. The UBS Global Real Estate Bubble Index gauges the risk of a property bubble on the basis of such patterns. The index does not predict whether and when a correction will set in. A change in macroeconomic momentum, a shift in investor sentiment or a major supply increase could trigger a decline in house prices.”

NBC Financial Markets

Updated Quarterly - Last Update: 2022 11

Housing Affordability Monitor

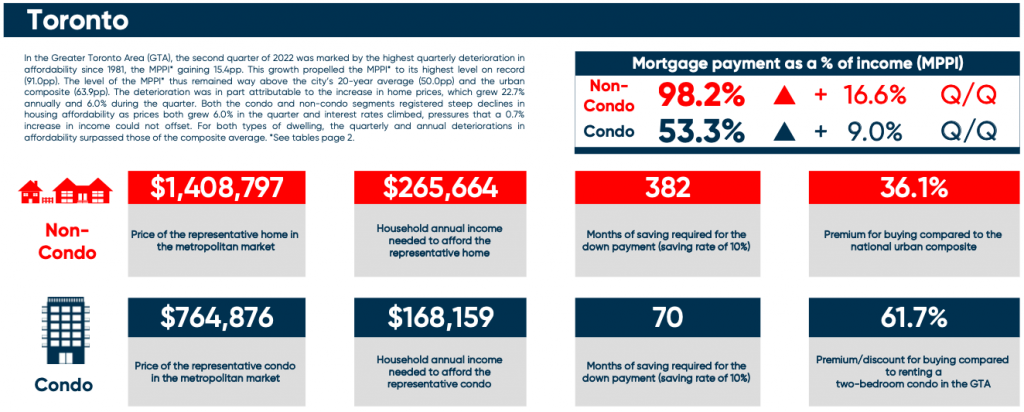

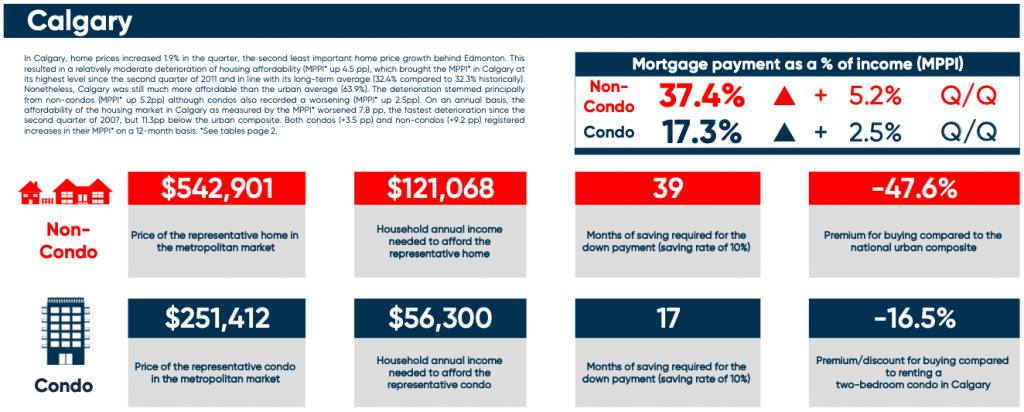

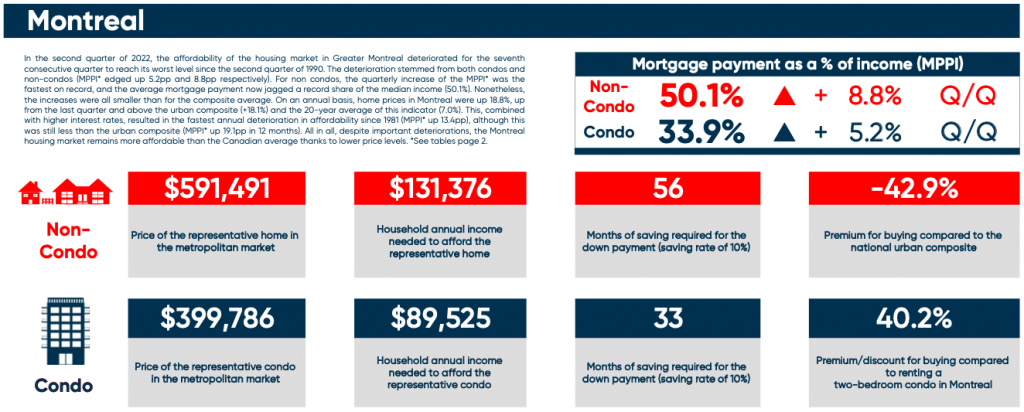

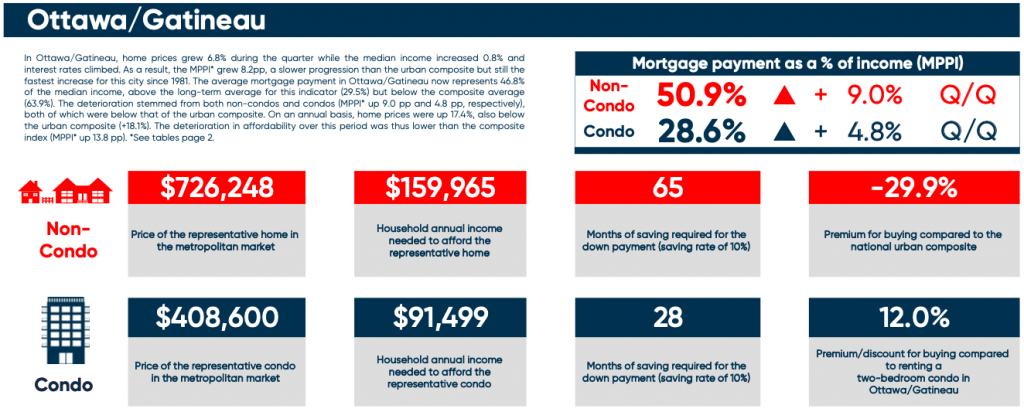

The National Bank Housing Affordability Report measures housing affordability in 10 major census metropolitan areas (CMAs) and summarizes the results in a weighted-average composite of the 10 CMAs. They measure two hurdles for the purchase of a home.

First, a household must save the downpayment amount (10% of pre-tax income for the minimum required downpayment). The second hurdle is the monthly mortgage payment (25-year amortization period and a 5-year term).

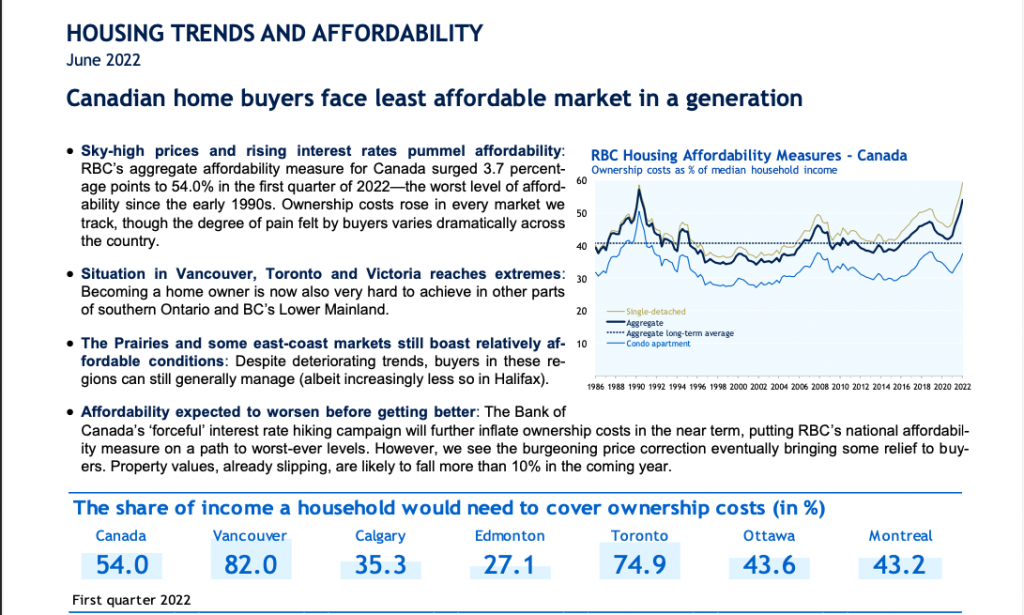

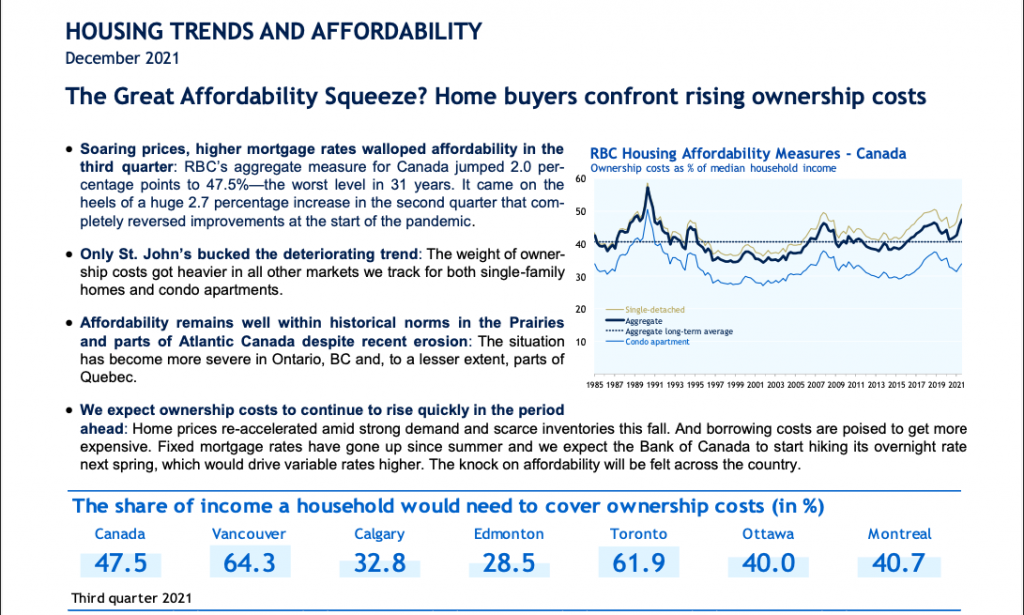

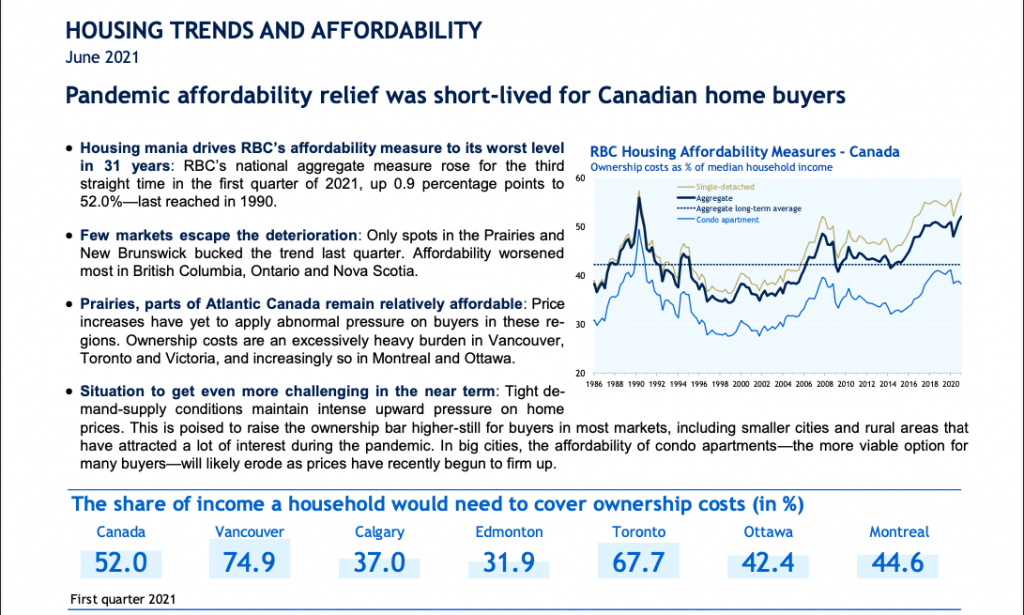

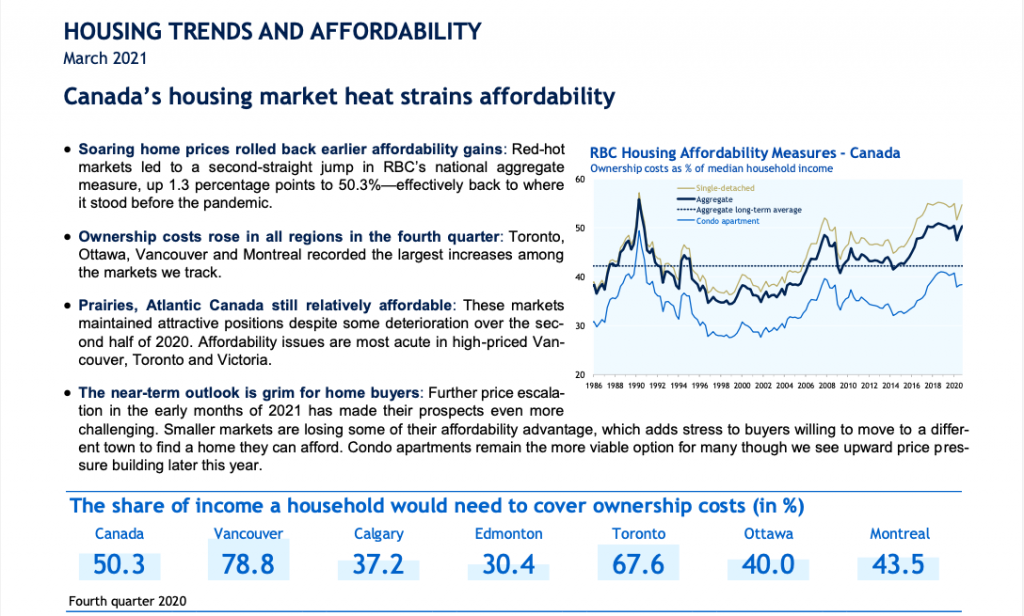

RBC Economics

Updated Quarterly - Last Update: 2022 06

Housing Affordability Report

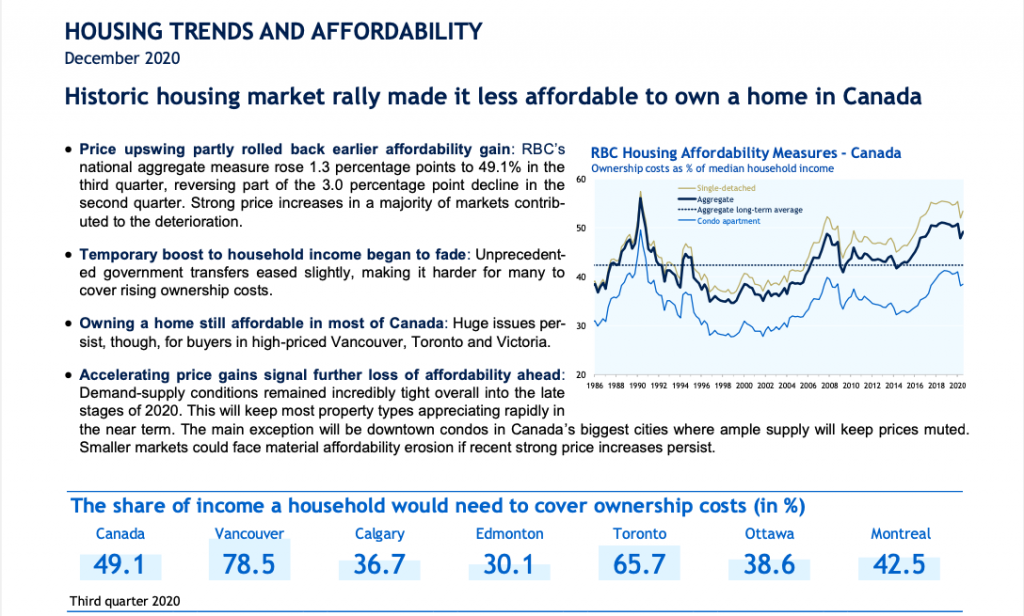

The RBC Housing Affordability Measures show the proportion of median pre-tax household income that would be required to cover mortgage payments (principal and interest), property taxes, and utilities based on the benchmark market price for single- family detached homes and condo apartments, as well as for an overall aggregate of all housing types in a given market.

Guides

The following forms and guides provide clients (represented by the brokerage) with brief explanations for some of the forms used in real estate transactions in Ontario, Canada.

Residential Purchase and Sale

Updated Yearly - Last Update: 2022

Agreements of Purchase and Sale Forms

- Form 810 – Working with a REALTOR®

- Form 100 – Agreement of Purchase and Sale

- Form 101 – Agreement of Purchase and Sale – Condominium Resale

- Form 120 – Amendment to Agreement of Purchase and Sale

- Form 121 – Notice to Remove Condition(s) – Agreement of Purchase and Sale

- Form 124 – Notice of Fulfillment of Condition(s) – Agreement of Purchase and Sale

- Form 127 – Condition(s) In Offer – Buyer Acknowledgement

- Form 170 – Consent to Advertise

- Form 801 – Offer Summary Document – For use with Agreement of Purchase and Sale

Residential Listing

Updated Yearly - Last Update: 2022

Listing Agreements & Related Forms

- Form 810 – Working with a REALTOR®

- Form 200 – Listing Agreement – Seller Representation Agreement Authority to Offer for Sale

- Form 244 – Seller’s Direction re: Property/Offers

- Form 208 – Entry/Access to Property Seller Acknowledgement

- Form 248 – Entry/Access to Property Tenant Acknowledgement

Buyer Representation

Updated Yearly - Last Update: 2022

Buyer Representation Agreements & Forms

- Form 810 – Working with a REALTOR®

- Form 300 – Buyer Representation Agreement – Authority for Purchase or Lease

- Form 320 – Confirmation of Co-operation and Representation – Buyer/Seller

Tenant Representation

Updated Yearly - Last Update: 2022

Tenant Representation & Lease Agreements

- Form 810 – Working with a REALTOR®

- Form 346 – Tenant Representation Agreement – Authority for Lease or Purchase

- Form 320 – Confirmation of Co-operation and Representation – Buyer/Seller

- Form 400 – Agreement to Lease – Residential